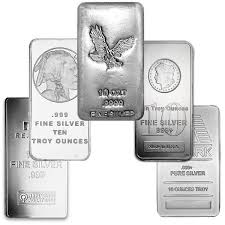

Silver Bullion

Buying Silver, Silver Bullion, coins, bars and rounds is an excellent way to get started in Precious Metals investing. Buying Silver is easy when you shop with your local and trusted Silver Bullion Dealer, San Diego Coin and Bullion. Aside from it’s industrial uses, Silver is produced in the form of Silver coins, bars and rounds from mints and Precious Metal refiners around the world. Silver is one of the world’s most important commodities and an affordable Precious Metal investment option.

Buy and Sell Silver Bullion In San Diego

For all your silver bullion needs, San Diego Coin & Bullion is the destination for you. Whether you’re eager to bolster your investment portfolio with silver bullion coins, rounds, or bars, or considering liquidating your silver assets, our team is ready to guide you through every transaction. With a diverse range of top-quality silver bullion products and competitive pricing, we cater to both collectors and novice investors alike.

Visit our silver buyers today to explore our selection and experience the exceptional service that sets San Diego Coin & Bullion apart.

Frequently Asked Questions about Silver Bullion

Silver bullion bars are manufactured through a process involving sourcing, refining, and minting. The process begins with acquiring raw silver from mines, recycling processes, or purchasing it in its raw form. The silver is then melted in a furnace to achieve a molten state and undergo purification to remove impurities and other metals.

Next, the purified silver is poured into molds of specific shapes and sizes, such as rectangular or bar-shaped molds, and allowed to cool and solidify. Once cooled, the solidified silver bars are removed from the molds. Finishing processes like polishing and stamping may be applied to achieve a desired appearance and standardize weight, purity, and identification marks.

The finished silver bullion bars are securely packaged to prevent damage and then distributed to dealers, collectors, or investors. The packaging often includes protective materials like plastic or tamper-proof packaging.

It’s important to note that specific minting and production methods may vary across refineries and mints, but the general process involves sourcing silver, refining it to high purity, casting it into molds, cooling and solidifying, adding finishing touches, and packaging for distribution.

The purity of silver bullion is important for several reasons. Firstly, it directly affects its value, with higher purity silver commanding a higher price. It also ensures authenticity and helps buyers determine the fair price they are paying for the actual silver content. Standardizing purity allows for consistency and uniformity in the market, facilitating fair transactions. Investors and traders rely on purity information to make informed decisions and assess potential resale value. Additionally, high purity silver is desired in industrial applications, such as electronics and medical equipment, where it ensures optimal performance. Having clear knowledge of the silver’s purity allows industries to select the appropriate grade for specific applications. In summary, purity is crucial for determining value, facilitating trade, and meeting the requirements of both investors and industrial users of silver bullion.

Adding silver bullion to your liquid assets offers numerous advantages to balance your holdings. Firstly, silver bullion serves as a tangible asset, providing a hedge against economic uncertainties and inflation. Its relatively lower price compared to gold makes it accessible to a broader range of investors, allowing for easier accumulation of wealth. Furthermore, silver’s dual role as both a precious metal and an industrial commodity ensures steady demand, providing stability to its value over time. With its inherent scarcity and enduring value, silver bullion stands as a reliable store of wealth and an essential component of a diversified investment portfolio.

Several factors influence silver bullion prices, including supply and demand dynamics, economic indicators, geopolitical tensions, and market speculation. Fluctuations in global industrial demand, particularly in sectors like electronics and solar energy, can impact silver prices significantly. Additionally, movements in the broader financial markets, such as changes in interest rates or currency values, can also influence investor sentiment towards silver. Moreover, geopolitical events, such as trade disputes or geopolitical unrest, may create uncertainty and drive investors towards safe-haven assets like silver, affecting its price. Visit our silver buyers in San Diego if you want to know the current cost of silver bullion.